2025 Interest Rate Announcement Schedule Bank of Canada

2025 Interest Rate Announcement Schedule Bank of Canada

2025 Interest Rate Announcement Schedule Bank of Canada

GST Rebate for First-Time Home Buyers The federal government has announced a new Goods and Services Tax (GST) rebate aimed at helping first-time buyers get into newly built homes or co-operative housing. While the legislation is still pending, the proposal outlines meaningful financial relief for qualified buyers and could reshape affordability in the new construction…

The Bank of Canada has scheduled several important dates for its 2026 policy and interest rate announcements. Here’s a list of those key dates: All 2026 Bank of Canada interest rate announcements will take place at 09:45 (ET), and the Monetary Policy Report will be published concurrently with the January, April, July and October rate announcements. Want to see the…

2025 Bank of Canada interest rate announcements The scheduled dates for the interest rate announcements for 2025 are as follows: All 2025 Bank of Canada interest rate announcements will take place at 09:45 (ET), and the Monetary Policy Report will be published concurrently with the January, April, July and October rate announcements. As of today, September 17th…

It’s a Christmas Gift! As of Dec 11th 2024, Canada’s prime lending rate is now 5.45%! That’s a 50 basis point drop! Canadian Economic Performance and Housing Market Update The Bank of Canada decided to cut its key interest rate by 50bps for the second time in a row during this meeting, just like the markets expected….

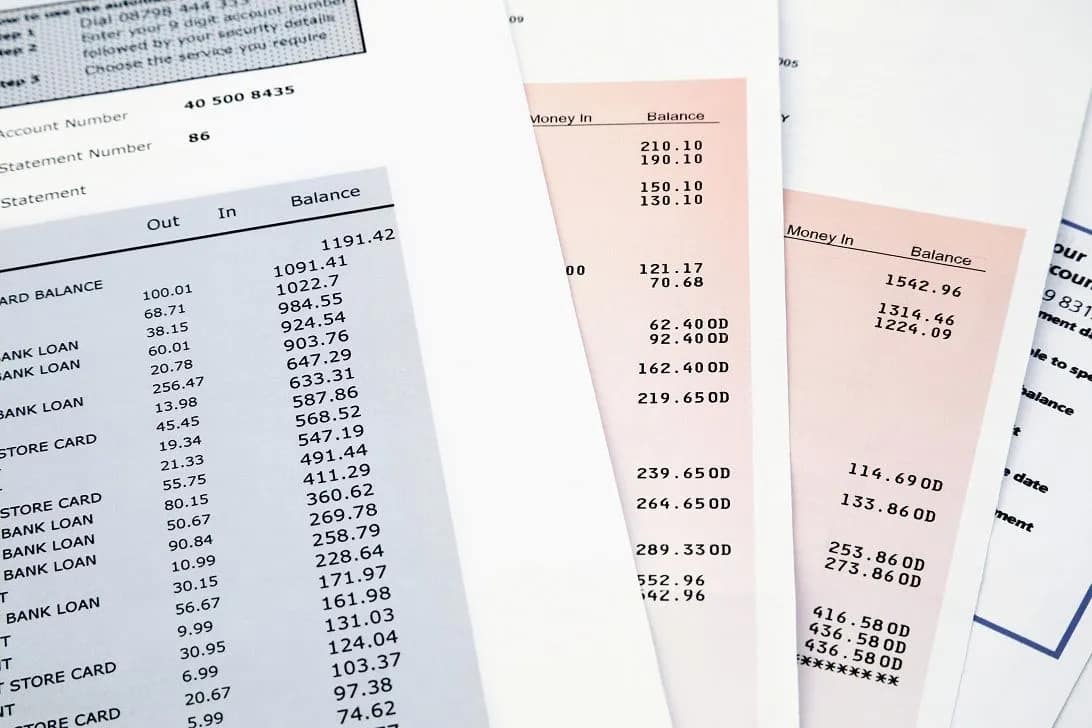

Mortgage Paperwork & Documentation When you’re applying for a mortgage, it all comes down to the paperwork. Lenders want to see proof of everything—no one’s taking anyone’s word for it these days. When a lender approves a mortgage, they need to have all the right documents in their file to back up their decision. The…

When you get to the mortgage application stage, you’ll need to gather a bunch of documents for your lender. These help them understand your finances, ID, and the property you’re buying. Getting everything ready in advance will make the whole process smoother and keep things on track. Just keep in mind that each lender might…

Variable-rate & Adjustable-rate mortgages VRM’s (Variable Rate Mortgage) & ARM’s (Adjustable Rate Mortgages) are based on the prime rate in Canada. This means that the amount of interest you pay on your mortgage could go up or down, depending on the Prime. When considering a variable-rate mortgage, some individuals will set standard payments (based on…

Yay! The Bank of Canada announced a 50 basis point cut today! That means fixed rates are coming down too now, right? Sadly, this is wrong. But, why? While there is some loose correlation between the two, there is no causation. Fixed rates are based on the bond yield, and surprisingly also, the US 10…

As of October 23rd 2024, Canada’s prime lending rate is now 5.95%! That’s a 50 basis point drop! The bond yield on the 22nd was trending upwards for no apparent reason, but maybe now with this overnight rate (and therefore prime rate) decrease it will help the bond reverse directions! That being said, this article…

Get ready for some exciting changes to mortgage default insurance rules, effective December 15th, 2024! These updates are designed to make homeownership more accessible for a wider range of buyers. Higher Price Cap for Insured Mortgages The maximum price for homes eligible for insured mortgages is increasing from 1 million to 1.5 million. This means more buyers…