Essential Paperwork You Need for Mortgage Approval

Mortgage Paperwork & Documentation

When you’re applying for a mortgage, it all comes down to the paperwork. Lenders want to see proof of everything—no one’s taking anyone’s word for it these days.

When a lender approves a mortgage, they need to have all the right documents in their file to back up their decision.

The specific documents you’ll need will depend on your personal financial situation, how you earn your income, and whether you’re a resident of Canada.

Here’s what you can expect to find below:

- What to do if you don’t have a scanner.

- A list of the most common documents needed for mortgage approval, plus a brief explanation of why each one is necessary, along with sample documents for reference.

This guide will help you stay on track and get everything ready for your mortgage application.

No Scanner? No Problem…

PDF is the go-to format for submitting mortgage paperwork.

If you’ve only got paper copies and don’t have a scanner, don’t worry! You can use your smartphone to take photos of your documents and turn them into PDFs, just like a scanner would.

One app I recommend is Fast Scanner. It’s free and works for both Apple and Android phones. It can handle both single-page and multi-page docs.

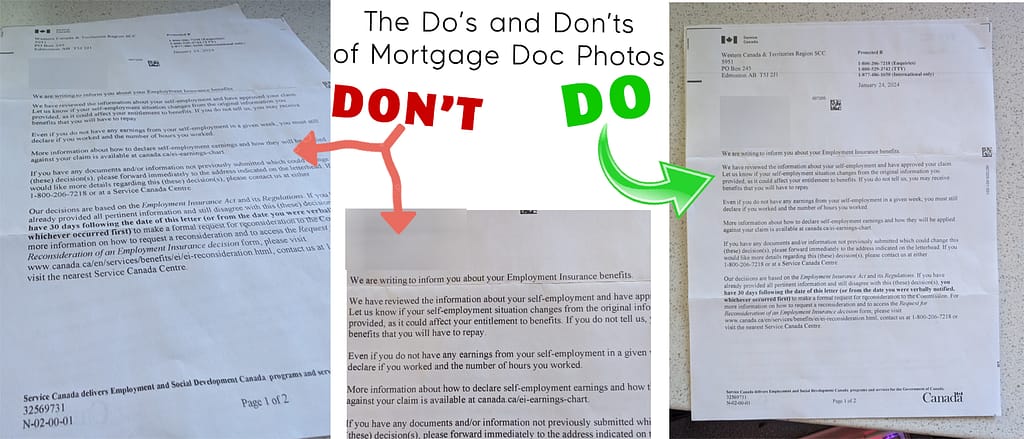

When you’re snapping photos, make sure to do it right so the documents are clear. Here are a few tips:

- Turn on your flash for the best lighting

- Lay the document flat on a table or the floor, and keep your fingers out of the shot

- Make sure the entire document is in the frame—no chopped-off corners

- Take the photo straight on, not at an angle

This way, you’ll get nice, clear scans that are perfect for submission! (and don’t fret, if the app won’t work for you, I’ll take jpg files too 🙂 )

When taking photos of your documents please ensure that all 4 corners of the document are visible, that no parts of the page are cut off, and that the text on the page is legible. Don’t forget that we need ALL pages of the document, so even if it’s 4 pages and the last page is 2 lines of text, please sent it over – the want to make sure that nothing is being hidden

Forms of ID

| Sample Driver’s License This is the most common form of identification used to show legal name and current address. | Sample Permanent Residency Card This document is used to prove Permanent Resident status in Canada. |

Personal Income Docs

Letter of Employment (a.k.a. LOE, Job Letter or Employment Letter) is a standard requirement for all mortgage applications. The job letter goes hand in hand with a paystub. The Employment letter shows Lenders the details of the applicant’s position and the paystub confirms that the applicant is in fact working for that employer and earning the amount stated on the letter.

| Sample Paystub This provides a breakdown of your earnings and is a cross reference to the employment letter to confirm your income. |

Income Tax Docs

| Sample Notice Of Assessment (NOA) The Notice of Assessment is issued by CRA as confirmation of your taxable income and whether there is money owing to CRA or not. |

Sample T1 General

If you are self-employed or have multiple sources of income, the T1 General provides a breakdown of all of your gross and net earnings.

Down Payment Docs

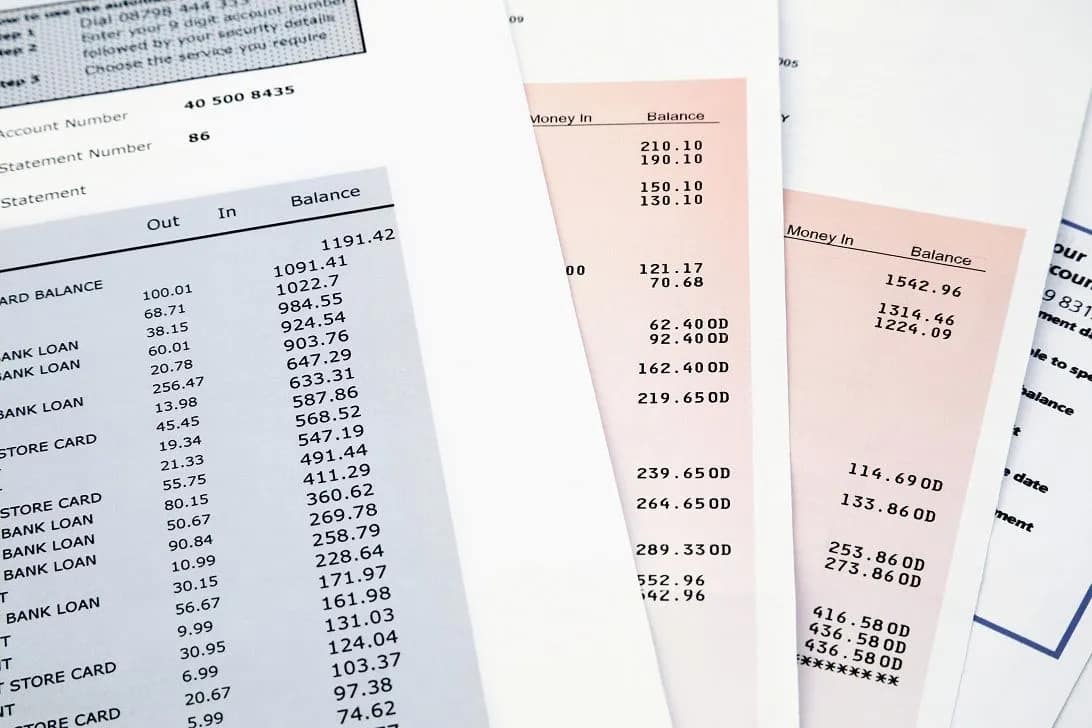

| Proper Bank Statements As previously mentioned, we need 4 months of bank statements for your down payment account (and sometimes to prove other forms of income) and if you’ve transferred money between accounts or made any large deposits, then we will need statements for those accounts as well to show the source of the transferred funds. When you submit bank statements to your broker or advisor, please ensure it shows these very important things: Your name. Yes, the statement must have your name (or how else do we know that this is your account and not your neighbours?) The date range that the statement covers The account number NO REDACTED INFORMATION – No really. Please don’t do it. We honestly don’t care if you’re subscribing to OnlyFans, or if you visit the beer store every day, I promise. |

| Gifted Down Payment Most lenders will accept gifted down payment. There are some restrictions, so check with your broker. Below is a sample of what a gift letter would look like. Each lender has their own template, so please wait for your broker to send you the correct one. |

Property Docs

| Sample Property Tax Statement The property tax statement is issued annually by the city or municipality you live in as a notice of what your property taxes for that year will be. |

| Sample Mortgage Statement If you currently have a mortgage, your mortgage Lender will issue an annual statement outlining the details of your mortgage such as the remaining balance owing, your mortgage payment, interest rate as well as the previous year’s activity. |

If you don’t have a lot of established credit, whether you are young, new to Canada, or possibly you just don’t use credit much, Lenders will often request something commonly referred to as “alternative forms of credit.” What they are looking for is proof that you are capable of making regular payments on something. A preferred form of alternative credit is a “rent” or “landlord letter” because usually a monthly rent payment is a similar amount to what a mortgage payment would be so Lenders like to see that you’re capable of a significant financial responsibility.